How Do I Pay Myself as a Sole Trader?

The hard effort that you put into your business needs to be rewarded. When you are a sole trader, you can withdraw cash from your business, called “Drawings” at any time. There may be a constant tension between “how much money does my business need?’ and “how much money do I need to live on?”. It’s easy to fall into a trap of muddling up your business and private expenses. And don’t forget your taxes!

Can I Pay Myself PAYE Wages or Salary?

When you are a sole trader, you can’t put yourself on the payroll like other employees and you can’t pay yourself a PAYE wage or salary. This means that you must put aside money to pay your income taxes, student loan and Kiwisaver from your profits before you take drawings.

Keeping Separate Bank Accounts for Business, Tax and Personal

We recommend that you have at least three bank accounts. The Business and Tax accounts are linked to your Xero or other accounting software. You receive customer payments and pay your business expenses through the Business account. Every month or every week, you transfer an amount from your Business account to your Tax account to save for your GST, income tax and student loan payments. Set up a regular payment to your Kiwisaver provider from one of these accounts.

Every month, you transfer an amount of Drawings to your Personal account, which is not linked to your Xero or other accounting software. Your personal account is for your household expenses, food, personal entertainment and personal shopping. Your accountant doesn’t need to know the minutiae of your personal bank account for taxes, but you may need to keep track of personal spending for a mortgage application or personal budgeting.

How Much to Put Aside for Tax?

Firstly, some basic business truths. Cash and Profit are not the same. You can have a profitable business and be low on cash: funds tied up in unsold products, paying off loans, customers paying you slower than you are paying suppliers. On the flip side, you might not have a profitable business, but it has plenty of cash because you have received loans or put your own money into the business.

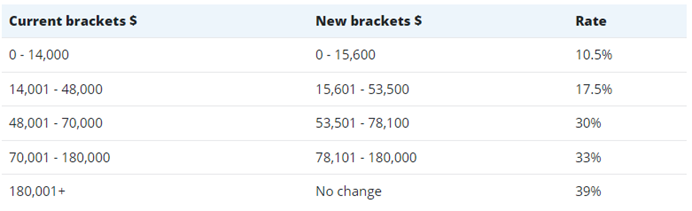

Profit is the difference between income and expenses. For a sole trader, tax is calculated on that profit alongside your income from other sources. If your business is your side hustle and you are already earning over $78,000 a year, then the tax will be 33% or 39% of that profit. Check out Figure 1 below, our JDW personal tax calculator 2025 or IRD has a handy calculator tool: https://www.ird.govt.nz/income-tax/income-tax-for-individuals/how-income-is-taxed/work-out-tax-on-your-yearly-income (Note: as at 16 June, IRD calculator has not been updated.)

If you have a student loan, then you will need to set aside a further 12% for every net profit dollar you earn over the repayment threshold. For the 2025 tax year the annual repayment threshold is $24,128.[i]

If you are GST registered, then you will also need to put aside your GST. Run your GST return report each month (even when GST is not due) to see how much you need to save. You’re not alone in thinking that there’s not much left over for you after paying your taxes, but they are a fact of life.

Figure 1 Tax Rates and Thresholds Source: budget.govt.nz [ii]

How Much Can I Take in Drawings?

That depends on how much you need and how much your business needs. If you are budgeting carefully, you will have a clear idea of when and how money you need. Consider these issues:

When Does My Business Have Payments Due?

Typical payment days may be 1st of the month rent, 20th of the month bills and PAYE, 28th of the month tax payments. If you buy stock in bulk, when do you have to pay for your order? When do you pay your team? When do you pay your term loans or leases?

How Reliable is Income?

If income is inconsistent, such as when you are starting out or when you have lost a large client, then it would be helpful to leave more funds in the business to cover expenses.

Rainy Day Fund & Emergency Fund

In addition to your three bank accounts, consider having a Rainy Day Fund for unexpected expenses (car repairs) and an Emergency Fund for covering expenses when income stops suddenly (family illness). You can read more about them here: https://www.jdw.co.nz/saving-for-the-next-rainy-day

How Much Am I Worth?

If you were employing someone else to do your role, how much would you pay them? Consider your level of experience, skills, your responsibilities as owner-manager and the hours you work. If you can’t afford to pay that much yet, consider what needs to change to make it happen.

How Much Do I Need to Live Comfortably?

Is your business income needed to cover the mortgage, rent or weekly groceries? It is just as important to have a household budget as a business budget. For some people, money feels like a dirty word to bring up in a relationship. But we all know of relationships which have been tested and broken because money problems.

In theory, sole traders can take as many drawings as they like, but that would be imprudent. Keep business and personal finances separated and save for taxes as you go. Remind yourself that cash doesn’t equal profit, and the business may need more help when you have big bills coming up. Aim to pay yourself what you are worth, and what your family needs to live. If you need help to uncover the changes you need in your business to make that happen, reach out to your friendly chartered accountant to help you.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, auditors, business consultants, tax advisors, trust and business valuation specialists.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your adviser or the author.

[i]

https://www.ird.govt.nz/student-loans/living-in-new-zealand-with-a-student-loan/repaying-my-student-loan-when-i-am-self-employed-or-earn-other-income

[ii] https://budget.govt.nz/budget/2024/at-a-glance/tax-relief.htm

Contact Us

Office Location: 127 Main Highway, Ellerslie, Auckland 1051, New Zealand

Postal Address: PO Box 11053, Ellerslie, Auckland 1542

Phone: (09) 579 7096

Email: results@jdw.co.nz