How to Make the Working Capital Cycle Work for Your Business

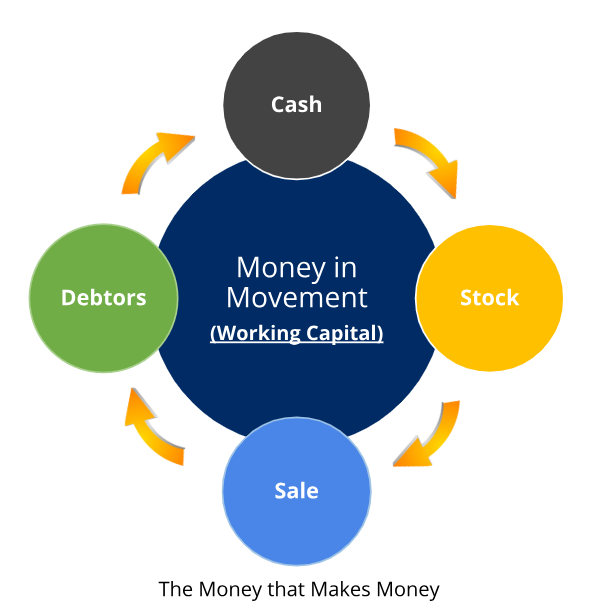

Sometimes dubbed the Cash Flow Cycle or Cash Conversion Cycle, the Working Capital Cycle is a measure of your business efficiency. How can you make it work for you? Imagine being able to scale your business from using your working capital wisely, instead of more debt.

Working Capital Cycle (WCC) calculation

Investopedia defines the working capital cycle as follows: “The working capital cycle represents the period measured in days from the time when the company pays for raw materials or inventory to the time when it receives payment for the products or services it sells.“ [i]

Working Capital Cycle (WCC) = Inventory Days + Receivable Days – Payable Days

[i]

https://www.investopedia.com/terms/w/workingcapitalmanagement.asp#

Simply put, it is the number of days it takes to turn inventory into cash. The term Working Capital Cycle is more far reaching than Cash Flow Cycle or Cash Conversion Cycle, as it recognises all current assets and current liabilities. For service businesses, rather than physical inventory, you might consider how long it takes for projects or jobs to turn into cash.

The shorter the working capital cycle, the more likely the business can fund itself. The longer the cycle, the more reliant the business is on debt or owner investment. If you pair business efficiency with a healthy gross margin, you can grow your business with every cycle.

Improving Your Working Capital Cycle

As the working capital cycle is a combination of inventory days, receivables days and payables days, here are some tips to manage them.

Inventory Days on Hand

You can improve cashflow by holding less inventory. Not only is cash tied up with inventory but there are holding costs to consider, such as storage, warehouse personnel and management and interest costs. Adopt Just In Time (JIT) and Lean practices so you only hold enough stock to cover your needs until your next order arrives. With Covid-19 and shipping delays, many businesses are holding higher inventories than they would like. Consider diversifying your suppliers to have backup sources of stock and holding buffers in your most important stock.

Analyse your inventory on a line-by-line basis, for profitability and appropriate stock levels. Reduce inventory wastage, over supply and backlogs, by having better inventory management systems and quality control. Reducing wastage and rework improves your gross margin. Quit your obsolete stock because it ties up cash. If you have a high degree of product customisation, make sure you can charge for it.

If you buy goods in foreign currency and sell them in NZ dollars (or vice versa), exchange rates will impact your costs, prices, and profit margins. To manage this risk, consider using forward exchange contracts or hedging to lock in favourable rates. Additionally, include pricing revision terms in your customer contracts for periods extending beyond 30 days.

Customer Receivables Days on Hand

You can improve cashflow by reducing your debtor days (receivables days). Send invoices promptly to your customers and follow up on overdue accounts. Make sure your payment terms are clearly defined and easily enforced. Clearly set out interest and collection costs for defaulters. Offer direct debit or automatic payment options to make it easy for customers to pay you on time.

You can save yourself a lot of future grief with your onboarding and credit application policies. Your prospective customer needs to pass credit checks and financial enquiries before you offer them trade terms. If the sale requires you to purchase expensive equipment, is a particularly large order, or you need to invest a lot of time and resources, it is acceptable to ask for an upfront deposit, and progress payments for longer projects.

While offering incentives for early payment may seems attractive, discounting has a cost, so think about different ways to reward your customers. Develop strong relationships with your larger customers, so they are more likely to pay you, even in tough times.

Accounts Payables Days on Hand

Set up trade accounts for your most frequent purchases. If you can increase creditors days, the time it takes you to pay bills, you can improve cashflow. This doesn’t mean taking advantage of your suppliers, by not paying them! But if you can negotiate longer supplier terms without penalties, this would be an attractive option. Sometimes you may need to increase your order size to negotiate better terms. Or you may have to pay sooner to get a discount. A 2% discount to pay within 30 days is like receiving interest at 24% per annum!

Where Do You Start on Improving Your Working Capital Cycle?

When there is a downturn in the economy, it highlights the problems that businesses have with their working capital cycle. Review your current systems for managing inventory, supplier payments and customer receivables. Seek help from your chartered accountant to review your numbers and improve your cash flow. If you need further guidance or a fresh perspective, don’t hesitate to reach out to us at JDW Chartered Accountants. We’re here to support you in navigating these challenges and optimizing your working capital management.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, business consultants, tax advisors, trust and business valuation specialists.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your adviser or the author.