Minimum Wage and Tax Thresholds

With minimum wages set to increase on 1 April 2023, more individuals will be paying tax at 30%. Is it time to review the tax thresholds, especially the $48,000 and $70,000?

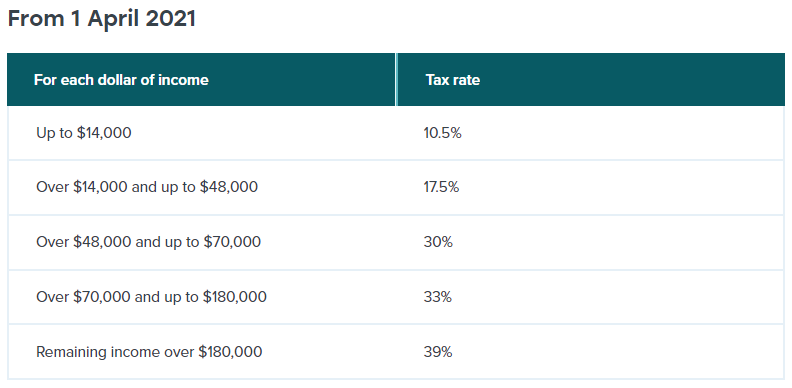

Current Tax Rates and Thresholds

The current tax rates and income thresholds, as at 1 April 2021 are shown in the IRD Table below. They are marginal tax rates, so each dollar you earn up to $14,000 is tax at 10.5% then each dollar between $14,001 and $48,000 is taxed at 17.5% and so on. (Figure 1.)

Individual taxpayers earning between $24,000 and $44,000 may qualify for a $520 independent earner tax credit (IETC). From $44,000 to $48,000 the IETC reduces by 13 cents for every dollar over $44,000.

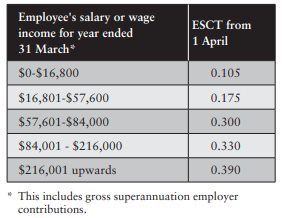

The tax thresholds also impact on Employer Superannuation Contribution Tax (ESCT) which is deducted from Kiwisaver Employer Contributions. ESCT $ thresholds are 20% higher than income tax thresholds because they take the employer contributions into account. (Figure 2.)

Increase in Minimum Wage 1 April 2023

Government is increasing the minimum wage on 1 April 2023, from $21.20 to $22.70 per hour. The starting-out or training wage increases from $16.96 to $18.16 per hour. A minimum wage earner working 40 hours a week, 52 weeks a year, will earn $47,216 (up from $44,096) a year or $3,935 (up from $3,675).

The extra gross income is $3,120 a year or $260 a month.

The extra PAYE deducted under code ME is $83.11 ($655.93-572.82) or 32%. [i]

The marginal tax rate on the boost in minimum wage is 32%, far higher than the 17.5% you would expect, because of the reduction of IETC.

Conclusion

It is time for the Government to increase its tax thresholds, given that individuals earning the minimum wage will be paying a marginal tax rate of 30% or above. If the Government is serious about assisting individuals to afford the increases in the cost of living, then this is one way it can do it easily.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, auditors, business consultants, tax advisors, trust and business valuation specialists.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your adviser or the author.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

[i] PAYE has been calculated from monthly tax tables in IR341 Four-weekly and monthly

PAYE deduction tables 2023, April 2022.

Contact Us

Office Location: 127 Main Highway, Ellerslie, Auckland 1051, New Zealand

Postal Address: PO Box 11053, Ellerslie, Auckland 1542

Phone: (09) 579 7096

Email: results@jdw.co.nz