Residential Property Investors: Interest Deductibility Update August 2022

The residential property interest limitation rules have passed into Law. But there is an amendment for build-to-rent developments.

Build-to-Rent amendment

Government has announced a vital amendment for build-to-rent development, but it is unlikely to improve matters for any of the landlords in our tax agency list.

Owners of build-to-rent assets can claim interest costs relating to these assets for as long as the asset is held and operated as a build-to-rent development.

- That tenants must be offered a fixed-term tenancy of at least 10 years with the ability to give 56 days’ notice of termination, but they may agree to or request other tenancy offers.

- The developments must have at least 20 dwellings in one or more buildings that comprise a single development, on either a single parcel of land or multiple contiguous parcels;

- the dwellings and any common land or facilities for those dwellings must have a single owner;

- dwellings can be held in one or more titles;

- the buildings that a build-to-rent dwelling is in, can include other dwellings or commercial premises that do not form part of the build-to-rent development;

- and the dwellings are used or available for rent under the Residential Tenancies Act;

The requirement for “20 dwellings in a single development” rules out all but the biggest landlords. We have clients with more than 20 residential rentals, but they are in different suburbs, not in multiple titles sharing common borders. So if you were a landlord hoping for some leniency on the interest limitation rules, you will need to look elsewhere.

Interest Limitation for Residential Rentals – a reminder

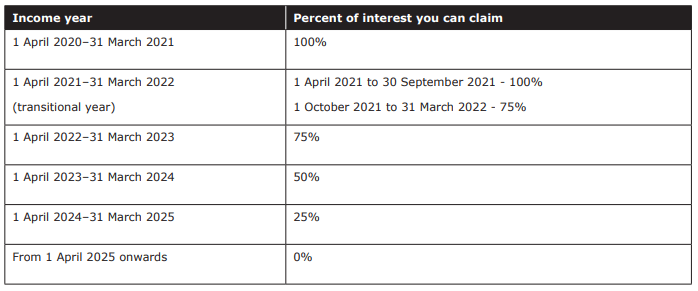

From 1 October, you can continue to claim interest if you acquired the property before 27 March 2021, but the percentage of the interest claimable reduces each year until 31 March 2025.

Development Exemption and New Build Exemption

The development exemption applies for interest relating to land that you develop, subdivide

or build on to create a new build.

The new build exemption is for properties which received its Code of Compliance Certificate on or after 27 March 2020 (not 2021 as stated in initial draft). It can include modular and relocated homes. If you convert and existing dwelling to multiple dwellings or a commercial building into residential dwellings, they can qualify as new builds. It applies also for purpose-built rentals, large-scale residential developments.

The exemption will apply to anyone who owns the new build within the 20-year fixed period, and the exemption does not reset when the property is sold.

Borrowing for Business Purposes and Land Business Exemption

If you’re borrowing against your residential property to fund your business, e.g. buying a truck for your transportation business, then you can still claim the interest deduction.

Similarly, the land business exemption will allow you an interest deduction if you are developing, subdividing, or in the business of land-dealing or erecting buildings.

Flatting or Home Business Exemption

The interest limitation would not apply for income-earning use of an owner-occupier’s main home, such as a flatting situation. Nor would it apply for emergency transitional, social or council housing. Other exemptions for residential property include hotels, motels, employee accommodation, student accommodation, retirement villages.

If you use part of a residential property for your business, such as consulting rooms then that portion of the interest may be claimed as a deduction. Bed and breakfast operations offering short term accommodation may be able to claim interest where the owner lives on the property, but not when it is a separate property.

The interest limitation also applies for properties that rent out and also use privately like holiday home.

Taxable Sale Exemption

If the sale of property is taxable, e.g., under the bright-line rules, then previously denied interest deductions may become available to offset the gain on sale.

Refinancing for rental property bought before 27 March 2021

If your initial loan drawdown for settlement was after 27 March 2021, but the acquisition date was before 27 March, you can follow the staged removal as if the loan was drawn before 27 March 2021. But if you borrow further, such as to make improvements, the interest on the new debt is not deductible from 1 October 2021.

If you have a revolving credit or other variable loan, only the interest on the 27 March 2021 loan amount will be eligible for the interest limitation calculation. The rest of the interest will be non-deductible.

Transferring to Related Entities

If you restructure how you hold the property after 27 March 2021, you may be able to carry over the same interest deductibility during the interest phase out period. This includes some transfers to family trusts, to or from look through companies (LTC) or partnerships, relationship property settlements and transfers on death.

What Next?

We have a calculator to help you estimate the cashflow requirements for your rental property with the interest deductibility changes. If you would like a copy, please email the author. For those of you with businesses and investment properties, it may be possible to restructure your loans to maximise interest deductibility.

Please feel free to contact us, your real estate agent and your mortgage broker to discuss your options.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, auditors, business consultants, tax advisors, trust and business valuation specialists.

An article like this, which is general in nature, is no substitute for specific tax advice. If you want more information about the issues in this article, please contact the author.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

Contact Us

Office Location: 127 Main Highway, Ellerslie, Auckland 1051, New Zealand

Postal Address: PO Box 11053, Ellerslie, Auckland 1542

Phone: (09) 579 7096

Email: results@jdw.co.nz