Personal Tax Updates from Budget 2024

The NZ Government Budget 2024 included a long-awaited expansion in tax thresholds from 1 July 2024. What does this mean for employers and individual taxpayers?

Why the Increased Tax Thresholds?

When the minimum wage increased to $22.70 an hour on 1 April 2023, it meant that fulltime minimum wage earners were earning over $44,000 and paying more than 17.5% marginal tax on each dollar over $44,000. JDW joined other voices in the call for the tax thresholds to be increased in our blog: https://www.jdw.co.nz/minimum-wage-and-tax-thresholds

Increasing the tax thresholds and extending the eligibility for independent earner tax credits helps households to cope with the increased cost of living pressures.

What Are the Updated Tax Thresholds and Rates?

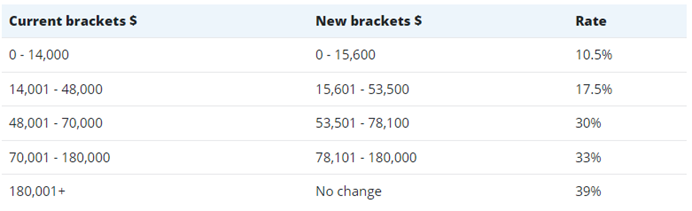

Figure 1 below shows the new tax thresholds applicable from 31 July 2024. Introducing these changes partway through the tax year, which ends in March 2025, creates a unique challenge: taxpayers will now have three additional tax brackets to consider.

The Independent Earner Tax Credit (IETC) threshold is increasing from $48,000 to $70,000 also. You can download an Excel calculator combining the tax rates, tax thresholds and IETC thresholds from our website: JDW Personal Tax Calculator 2025.

How Does this Change Affect Employers and Payroll?

If you are using online payroll software, the PAYE calculation will be updated automatically by your payroll software provider. If you use a desktop version, you will be prompted to download an update. Look out for messages from your payroll software provider before 31 July 2024. You will notice more money being paid to your employees and less to IRD for PAYE, but the overall payroll cost should be the same.

You will need to check if your employees are using the correct tax codes for secondary employment. Ask them to complete a new IR330 form in July.

How Does This Change Affect Individual Taxpayers?

If you earn more than $14,000 a year, you’ll notice the tax savings from your first pay after 31 July 2024. If you have a secondary employment, you may need to advise your employer of a new tax code so that the right rate of tax is deducted. Due to the timing of the PAYE changes, you may have a terminal tax to pay or income tax refund due, when your personal tax is calculated after 31 March 2025. This includes taxpayers whose tax returns are auto-assessed by IRD.

You will need to advise your bank or investment company if your Interest RWT is at the wrong rate. This doesn’t happen automatically.

If you pay provisional tax, you may want to discuss with JDW whether to estimate your provisional tax for 2025 year.

How Much Will My Family Save?

To find out how much you will save as a family, the NZ Government released a Budget Tax Calculator here: https://budget.govt.nz/taxcalculator/index.htm

The Budget 2024 Tax Calculator factors in the changes to the tax thresholds, IECT, changes to NZ Super, working for families and the new FamilyBoost for early childhood education.

Many taxpayers will welcome the increased income tax thresholds so they have more funds available for spending and savings. Be aware that you may need to contact your employer, bank or chartered accountant to make the most of your tax savings.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, auditors, business consultants, tax advisors, trust and business valuation specialists.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your adviser or the author. While every care has been taken in designing the JDW personal tax calculator 2025, the results should be used as an indication only.

Contact Us

Office Location: 127 Main Highway, Ellerslie, Auckland 1051, New Zealand

Postal Address: PO Box 11053, Ellerslie, Auckland 1542

Phone: (09) 579 7096

Email: results@jdw.co.nz