Xero Subscription Changes from September 2024

We have noticed Xero subscription costs increasing over the past three years, and there is a further shakeup happening between September 2024 and March 2025. This has many business owners and accountant asking: “Is it time to change?”

What is Changing for Xero Subscriptions from 12 September 2024?

The new plans take effect from 12 September 2024. This means if you sign on from that date, or upgrade or downgrade from that date, you will only be able to choose one of the new plans.

For existing subscribers, the migration path is being staggered between September and March 2025. More details are expected in September 2024. Xero will give us 60 days’ notice of the changes.

The Xero GST Cashbook subscription is being merged with the Xero Starter subscription to form Xero Ignite. If you don’t use the add-ons, then you will have an increase in functionality from this change.

The add-ons (Expenses, Payroll, Projects, Analytics Plus) are being bundled with different levels of subscriptions, rather than being added separately to a base subscription. Bundling will impact on pricing quite significantly for some clients, so that is why Xero is allowing longer for migrating these clients.

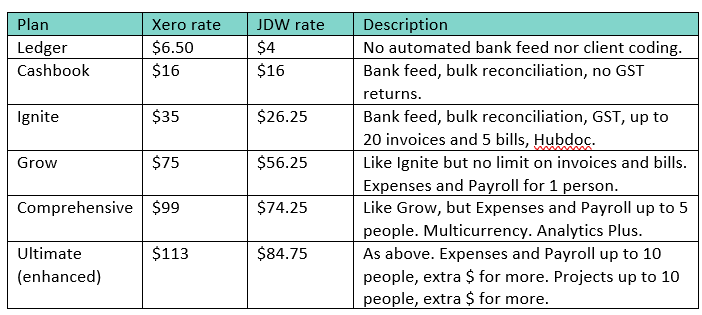

New Plans from 12 September 2024

You can access the full list of new Xero plans here. Subscriptions are paid monthly, and prices shown exclusive of GST. Two prices are shown in the summary below – the official Xero rate and the Gold Partner rate we offer to JDW clients.

Xero Add-On Subscription Migration Issues

We have identified issues for clients who currently subscribe to Expenses, Payroll and Projects add-ons. In some cases, their subscription costs will be consistent or drop overall as they already pay extra for additional users. But if they are on Starter and only have a single user on Projects or Payroll, they may find they have to pay more for the privilege. This is because they will have to jump to a more expensive package if they want to keep using those Add-ons. We are yet to see how Xero will manage the migration of these clients in September 2024.

Example Migration with savings:

A service company is currently on Standard, it uses Expenses for its two shareholder-employees, uses Payroll for one employee and all three people access Projects.

Current Cost is $71 Standard ledger + $5 extra Expenses user + $10 Payroll + $10 Projects (- $22.75 Gold Partner discount) + $14 two extra Projects users = $87.25. Under the Ultimate plan, they will pay $84.75, saving $2.50.

Example Migration with cost increases:

A consulting company is currently on Starter, it has no payroll and uses Projects for its one shareholder-employee.

Current Cost is $33 Starter ledger + $10 Projects (- $10.75 Gold Partner discount) = $32.25.

Under the Ultimate plan, they will pay $84.75, costing an extra $52.50.

Is It Time to Explore Other Options?

Possibly, but it’s best to do thorough research on pricing, feature and user experience before making a shift. We have listed a few suggestions below, but there is a wide selection of apps which integrate with Xero, in the Xero App Store.

For expenses, you could use Hubdoc which is part of Xero Ignite or higher. Or sign up to Dext which is $24+GST a month for up to 5 users.

For payroll, you could use PaySauce Simple which is $17 +GST for the first employee + $2 per additional employee.

For project management, Tradify Pro is $49 +GST per user a month, and has additional features like health & safety forms, job photos and subcontractor scheduling. If you have more than one user, then Ultimate works out cheaper.

If you wanted to move away from Xero altogether, then we suggest Reckon, MYOB Business, or Moneyworks for small and medium businesses. However, we consider that Xero still has the edge over its competitors in bank entry coding, data entry automation, GST reconciliation, and reporting from client and accountant points of view.

What Should We Do Now before 12 September 2024?

Xero has asked us to be patient and wait until September 2024 when they will announce their migration plan. In the meantime, we suggest that you check your Xero ledger subscriptions and which add-ons you use, then let us help you evaluate your alternatives. We don’t need to rush with making decisions, but we want to make sure that you are getting the best value from your accounting software subscriptions.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland and a Xero certified advisor. JDW is a professional team of qualified accountants, auditors, business consultants, tax advisors, trust and business valuation specialists.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your adviser or the author.

Contact Us

Office Location: 127 Main Highway, Ellerslie, Auckland 1051, New Zealand

Postal Address: PO Box 11053, Ellerslie, Auckland 1542

Phone: (09) 579 7096

Email: results@jdw.co.nz