AIM Provisional Tax finds its Target

The Accounting Income Method (AIM) of calculating provisional tax has been around for several years with very little uptake. But its usefulness is finally being discovered by small and medium taxpayers.

What is Accounting Income Method (AIM)?

AIM was introduced in 2017 to help small and medium taxpayers align their provisional tax payments to fluctuations in business profits or losses. It particularly suits businesses that are growing through out the year, has had a sharp decline in profitability, or has seasonal (lumpy) income.

You calculate your profit (or loss) for the year to date, make adjustments for items not in your accounting software (if you haven’t integrated debtors, creditors or stock for example), make further adjustments for non-taxable items (such as adding back fines and penalties) and then calculate tax on the resulting taxable income.

Why is AIM Useful for Small and Medium Taxpayers?

Provisional tax payments align with current profit, not prior year. If your profit is lower than last year, then your provisional tax payments will be lower too. In contrast, the standard provisional tax method takes last year’s residual tax, adds 5%, then divides it into three equal instalments. It doesn’t take into account fluctuations.

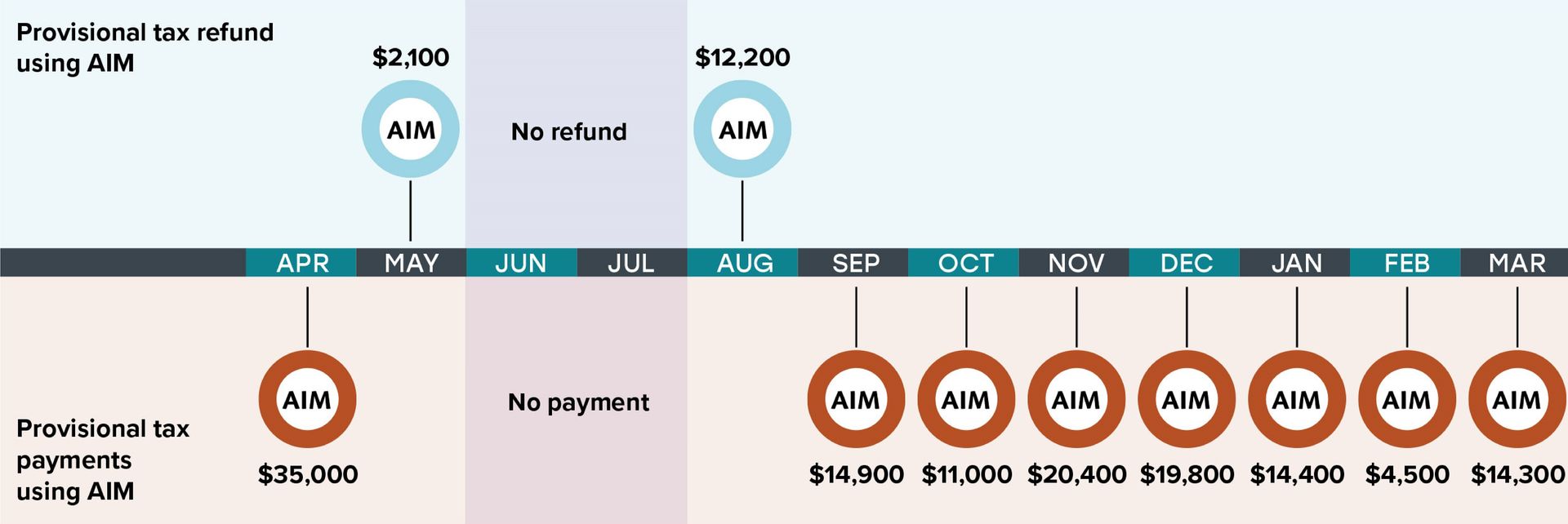

AIM addresses seasonality and fluctuations during the year. If you sell your harvest in November and earn nothing else during the year, then you’ll only pay AIM provisional tax for the November period. The other periods will be NIL or a refund.

You get provisional tax refunds during the year if you pay too much.

Its less hassle to get an AIM tax refund during the year, even for companies, because you don’t have to file an interim imputation credit account. AIM refunds are limited to the extent of AIM tax already paid for the year.

You don’t pay interest if you have terminal tax to pay. As long as you make your payments on time, you aren’t charged interest if the provisional tax payments are lower than your final tax liability. Contrast that with the Estimation method, where you pay interest when you have underestimated.

One provisional payment for company and shareholders. You can transfer excess tax credits from a company to its shareholders. The total amounts transferred to the shareholder are pro-rated against all of their provisional tax instalments for the year.

It fits with your GST cycle if you file GST monthly or bi-monthly. If you are a monthly GST filer, you lodge your AIM activity statement monthly. If you file GST every two or six months, you lodge your AIM activity statement every two months. You’re paying smaller amounts more regularly, so it’s less pressure on your cashflow.

If you already use accounting software, your AIM report is quick to prepare. MYOB Business (formerly Essentials and AccountRight) allows taxpayers to lodge their own AIM returns. Xero allows your tax agent/accountant to lodge your AIM returns on your behalf.

Downsides with using AIM

Higher provisional tax payments at the beginning of the year. If your profit spikes at the start of the year and then plateaus, you will have more provisional tax to pay at the start of the year too.

Extra accounting/bookkeeping fees. The extra reports come at a cost, because there are calculations to be done for every activity statement. But if you are already doing monthly reporting for your business, then the AIM activity statement is just one more report.

You can’t use tax pooling to fund provisional tax instalments. AIM provisional tax must be paid directly to IRD, not through a tax pooling company. Tax pooling can be used to finance the terminal tax payment though.

You may default to estimation option if you miss filing twice. If you don’t file two AIM activity statements, IRD will contact you and may choose to move you to estimation option and charge interest for underpayments.

You need to opt in every year. Opting in is easy, you just need to file an AIM activity statement. But if you forget to file your first two AIM activity statements for the year, IRD will assume that you have switched back to standard option.

AIM is Not for Everyone

AIM is available for individuals and companies with turnover under $5 million. It is not available for trusts and larger businesses.

If you are in multiple businesses or have a variety of income sources, then the calculation can be too complex for an AIM return. This is particularly true for individuals who have shareholder salaries from more than one company, plus PAYE and rental or investment income.

If you only want to look at your accounts once or twice a year, then the 2-monthly returns may not suit you because it is extra work. For instance, if your business is not GST registered or your income is from residential rental. But if you have seasonality in your income, it may be worth the extra effort to calculate provisional tax more often.

Conclusion

AIM appears to be a provisional tax method that has found its target. With cloud accounting, it is easier than ever to calculate monthly reports more accurately in a timely manner. Business owners are closely monitoring their cash, so smaller, regular tax payments are more favourable than larger instalments. The flexible nature of the method, allowing for tax refunds and interest free payments, is also finding favour, particularly when business conditions are uncertain and ever-changing.

If you want to know more about AIM and whether it will suit your business, please contact your JDW team.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, auditors, business consultants, tax advisors, trust and business valuation specialists.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your adviser or the author.