Tax Treatment of Business Vehicles

Once you have decided on which vehicle, and whether to lease or buy[i], you’ll need to consider the tax treatment of your vehicle decision. This is largely dependent on who owns the vehicle and business usage vs private usage.

[i]

https://www.jdw.co.nz/choosing-a-vehicle-for-your-business

Sole Traders and Partners Vehicle Ownership

Mainly Business Usage: Use a Proportion of Actual Costs

If your vehicle is only used for business, then you can claim the full running costs of the vehicle for business. Fuel, WOF, repairs and maintenance, insurance, interest and other finance costs, and depreciation. Depreciation is a gradual drop in value of the vehicle over time. For tax purposes, use the appropriate depreciation rate advised by IRD for your type of vehicle.

If you use the vehicle partly for private use as well, you can either claim a standard 25% of actual costs or keep a logbook to calculate the business percentage of motor vehicle use.

GST: If you are GST registered and mainly drive a vehicle for business, then you can claim GST on a proportion of the initial cost price and ongoing running costs of the vehicle, except for finance costs and depreciation which are GST exempt.

Mainly Private Usage: Use Kilometre Rate

You can claim business kilometres travelled as an expense deduction, using either the IRD kilometre rate or a reputable alternative such as AA vehicle running cost reports. The kilometre rate is a composite of estimated fuel, WOF, maintenance, insurance, depreciation and financing costs so you cannot combine the kilometre rate and actual costs.

No GST: There is no GST claim available using a kilometre rate calculation.

Employee vs Company Vehicle Ownership

Company Ownership, Mainly Business Usage: Use a Proportion of Actual Costs

If your vehicle is only used for business, then you can claim the full running costs of the vehicle for business. Running Costs include fuel, WOF, repairs and maintenance, insurance, interest and other finance costs, and depreciation. Depreciation is a gradual drop in value of the vehicle over time. For tax purposes, use the appropriate depreciation rate advised by IRD for your type of vehicle.

If the vehicle is driven by a shareholder-employee in a close company, then you can keep a logbook to calculate the business percentage of motor vehicle use or calculate FBT (discussed below). When you are using the business percentage to calculate the proportion of motor vehicle costs, the private portion is coded to drawings for that shareholder-employee.

GST: If your company is GST registered, it can claim GST on a proportion of the initial cost price and ongoing running costs of the vehicle, except for finance costs and depreciation which are GST exempt.

Company Ownership, Mainly Private Usage or Employee is not a Shareholder: Calculate Fringe Benefit Tax

If you don’t like keeping a logbook, or you mainly use the vehicle for private purposes, then you have to calculate Fringe Benefit Tax (FBT). If an employee is not a shareholder and uses the vehicle partly for private use as well, then FBT applies.

FBT is calculated quarterly or annually for employees or on an income year basis for shareholder-employees. It applies on many forms of employee benefits, like free or discounted goods, loans or insurance premiums, but we will only discuss FBT on motor vehicles here.

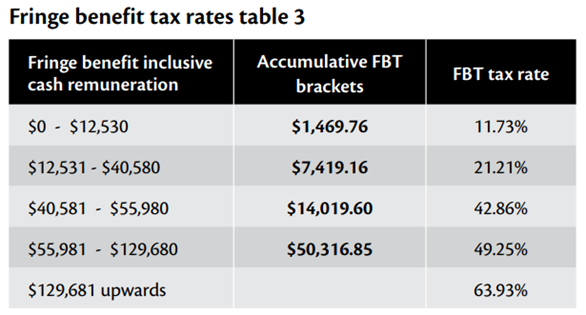

FBT arises for each day that a vehicle is available for private use. The taxable benefit is calculated at 5% of the cost price including GST per quarter or 9% of the opening book value including GST each quarter, times the number of days available for private use, divided by the number of days in the quarter. You can deduct contributions made by the employee such as paying for fuel or shareholder current account journal. Then you multiply the taxable benefit by the FBT rate, either the single rate 63.93% or the alternate rate 49.25%.

GST: You claim GST on the initial cost price and ongoing running costs of the vehicle, except for finance costs which are GST exempt. You do not have to apportion it. GST is payable on the taxable value of the fringe benefit and is included in the FBT return. You cannot claim back the GST on FBT in your GST return. Shareholder contributions are GST liable and included in income in your GST return.

Work-Related Vehicles

A work-related vehicle must satisfy the eligibility criteria: permanent company branding, gross laden weight 3,500 kg or less, designed to carry goods or goods and passenger equally. To qualify for the daily FBT exemption you must give the employee a letter of restriction stating that the work related vehicle is not available for private use except for travel between home and work, and for travel related to the business, and make quarterly logbook checks and keep a record of the checks.

Emergency Call Exemption

If the employee is required to use the vehicle for an emergency call in their role, then the vehicle is exempt from FBT for that day. This may be relating to health and safety of a person at any time, or to ensure the smooth operation of plant and equipment or providing essential services between 6pm and am on weekdays or during weekends or public holidays.

Business Travel or Repairs Exemption

FBT may not apply when the employee is away with the vehicle for work overnight or for more than 24 hours. If the employee is away without the vehicle, then you would need to store it where no-one else can access the vehicle for private use. There is also an exemption when the vehicle is broken down or being repaired for at least 24 hours.

Single rate FBT 63.93% or Alternate rate FBT 49.25%

If you use the single rate FBT calculation, you don’t need to make any further adjustments at year end. This is most appropriate for employees earning over $180,000 a year and shareholder-employees earning non-PAYE salaries.

Alternate rate FBT can be used for annual FBT returns or quarterly returns in June, September and December quarters. For the March quarter, you calculate a composite FBT rate, based on the employee’s after-tax PAYE salaries, other remuneration and allowances and taxable fringe benefits. The alternate rate often works out cheaper for employees earning under $180,000 but takes longer to calculate.

Employee Ownership: Use Kilometre Rate for Vehicle Allowance

You can reimburse employees for business kilometres travelled using either the or a reputable alternative such as AA vehicle running cost reports. The kilometre rate is a composite of estimated fuel, WOF, maintenance, insurance, depreciation and financing costs so you cannot combine the kilometre rate and actual costs. There is a maximum of 5,000 kilometres a year for shareholder-employees under this method.

No GST: There is no GST claim available using a kilometre rate calculation.

From the company's perspective, these reimbursements are tax-deductible expenses. For employees, they’re non-taxable income—provided the reimbursement amount is reasonable – and not subject to FBT or PAYE. If you prefer to pay a set monthly vehicle allowance, you must establish a benchmark distance through past experience and agree the monthly allowance figure with the employee.

Keeping a Vehicle Logbook or GPS Tracking

You can either buy a paper logbook and write down your odometer readings each trip, or you can download an app on your phone, like DriversNote. The logbook should differentiate between business and private travel, so you can work out a percentage of business travel. Typically travel between home and work is considered private travel, but there are exceptions when you must work from a home office, or you have work vehicle.

If you have a larger fleet of work vehicles, then consider GPS tracking solutions, like eRoad, TrackIT orFleetPin. In addition to tracking the kilometres travelled, you can use the GPS to assign jobs to the nearest available vehicle, for more efficient scheduling. Or you can locate a worker when they haven’t answered their phone. Several years ago, a plumbing client found out one of their workers was taking fewer jobs than the others, because they stopped at the beach frequently.

Final Thoughts

We recommend choosing a vehicle that suits your budget and functional needs, rather than whether you can get a GST reduction, or an income tax write off. Be aware of FBT requirements if you are operating in a company. Keep good records of business travel and expenditure, exempt days so you can maximise your tax entitlements.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, business consultants, tax advisors, trust and business valuation specialists.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your adviser or the author.