What is Trade Credit Insurance?

What is the cost to your business when a customer doesn’t pay you? We can insure against fire and theft, and we can also insure against bad debts.

Why Businesses Need Trade Credit Insurance

Bad debts cost businesses more than the amount of cash written off. There are the collection fees, interest costs, and stress of chasing payments. If you wrote off $100,000 bad debts and your gross margin was 25%, you would need sales of $400,000 to make up the lost cash.

Benefits of Trade Credit Insurance

A business is protected from customers turning into bad debts. They can enter sales contracts up to an approved amount, knowing that they will receive payment of their invoice even if the customer doesn’t pay them on time. It tightens a business’s credit management, by using the insurance company’s business intelligence. They have comfort in extending credit terms and limits based on the assessment of the insurance company.

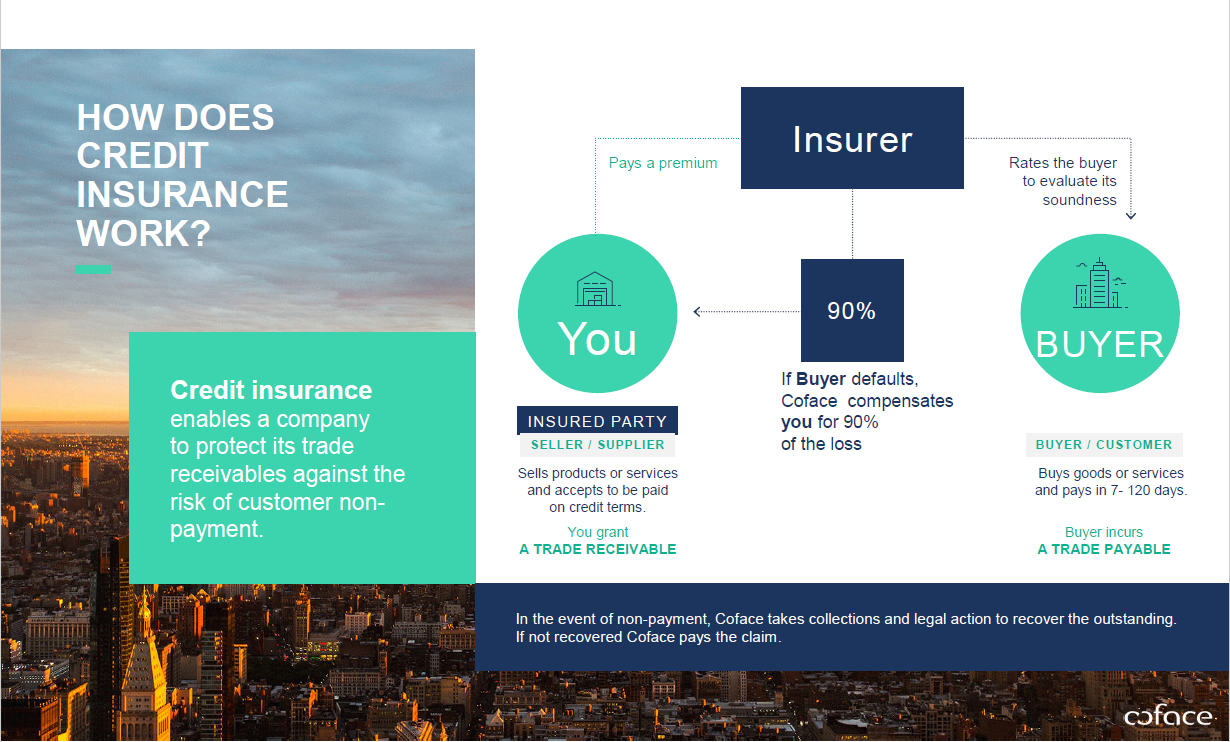

How does trade credit insurance work?

The business takes out an insurance policy to cover its trade receivables (customer balance owed to them), which is a significant asset class for the business. The insurer rates the customers and the industry and charges a premium to the business. Customer ratings are calculated with reference to historical credit reports, business intelligence relating to countries and industry sectors. For higher risk customers, they will also gather financial year end and management accounts. If the customer doesn’t pay within the agreed period, the insurer pays the business for a percentage of the loss (90% in the Coface example in Figure 1, but the percentage can differ) and takes action to recover the outstanding amount.

The Insurer is constantly updating information held about your customers, so they may contact you to advise suspending credit to a customer, if they become aware of issues with them.

If a customer is insolvent, you can lodge a claim for your loss from your insurer. You don’t have to attend a creditors meeting, and wait for receivers or liquidators to reach a compromise with creditors.

Who is trade credit insurance for?

Trade credit insurance is best for organisations that sell B2B – business to business. They sell on payment terms which are after the delivery date. Receivables are a significant asset to the business. The company is looking to grow, taking on larger orders or new international markets.

How Does Trade Credit Insurance differ from Debt Factoring?

Debt factoring, or invoice factoring, is when you sell your accounts receivables to a third party at a discount. You get a percentage of funds to reinvest within days, receiving the balance (minus the factoring company’s fee) when the invoice is collected. The cost is usually higher than trade credit insurance.

There are two type of debt factoring: recourse and non-recourse. Recourse means that if the customer refuses to pay, the business must purchase the invoice back from the factoring company and pursue the debt on their own. Non-recourse factoring companies typically charge a much higher fee and typically will only pay for the bad debt in the cause of bankruptcy.

Using trade credit insurance, the business makes the effort to collect the customer debt until the payment terms expire. When a customer defaults on their payment terms, trade credit insurance pays you out a percentage of the loss. If the customer goes into liquidation and can’t pay you, your business will receive more under trade credit insurance than a recourse factoring agreement.

Taking Uncertainty Out of Business

Business comes with a lot of uncertainties and risk, especially when expanding into new markets and larger customers. Trade credit insurance can help you to manage your risk, by giving you better financial data when taking on new customers, protecting you against bad debts and strengthening your balance sheet.

- Serena Irving

Serena Irving is a director in JDW Chartered Accountants Limited, Ellerslie, Auckland. JDW is a professional team of qualified accountants, business consultants, tax advisors, trust and business valuation specialists. Thanks to Nick Chan, Coface NZ Sales Manager, for sharing his knowledge.

Download a PDF version here or contact the author by email. Like our Facebook page for regular tips.

An article like this, which is general in nature, is no substitute for specific accounting and tax advice. If you want more information about the issues in this article, please contact your insurance adviser or the author.